-

Call: +91-9840269190

Call: +91-9840269190

-

Mail: hr@voltechgroup.com

Mail: hr@voltechgroup.com

Why Delaying Your 2026 Payroll Switch Could Cost You ₹29 Lakhs: The Complete Guide

- Home

- -

- Blog

Why Delaying Your 2026 Payroll Switch Could Cost You ₹29 Lakhs

- By Syari Raju

- Published: January 18, 2026 | Next Review: March 1, 2026 (post-Budget 2026 updates)

Quick Verdict:

Should you delay switching payroll providers in 2026? No. Delaying exposes your business to a 3.85% unbudgeted labor cost increase from the "27th pay period" calendar anomaly, ₹8-12 Lakh penalties from new 50% Basic Pay rules and legal liability from 48-hour exit settlement mandates. With the average cost of fixing a single payroll error now at ₹24,000 and India's four new Labor Codes in force, an unreliable provider isn't just inefficient - it's a compliance time bomb.

Executive Summary: What You Need to Know

• The 27th Pay Period Trap: 2026 is a rare "leap-payroll" year where bi-weekly schedules trigger 27 paychecks instead of 26.

• The ₹24,000 "Error Tax": Every payroll mistake costs ₹24,000 in direct processing and indirect labor to fix.

• The 48-Hour Rule: New 2026 mandates require full and final settlements within two working days of employee exit.

• The 50% Wage Rule: Basic pay must now equal at least 50% of total CTC—legacy systems failing this calculation trigger automatic PF penalties.

The 2026 Payroll Landscape in India

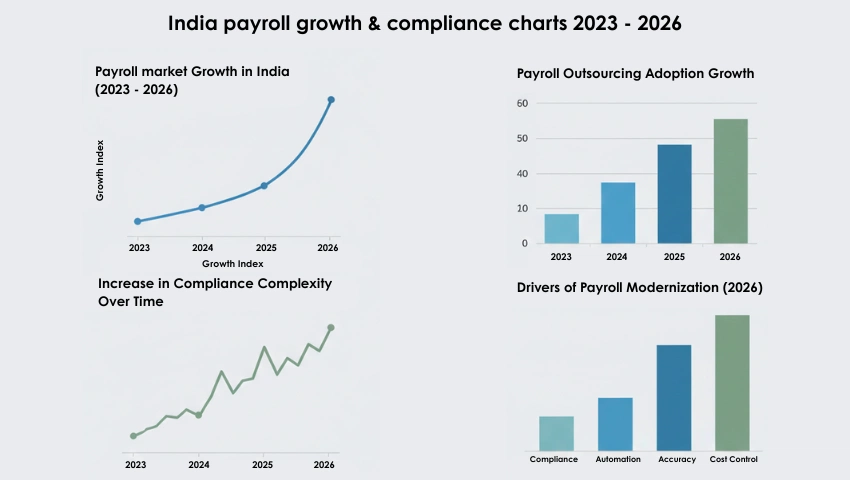

Why 73% of Indian Companies Are Reconsidering Their Providers

The Indian payroll market has reached an inflection point. According to NASSCOM's 2025 Payroll Benchmark Study, 73% of mid-market firms report dissatisfaction with their current payroll providers - up from 48% in 2023.

What's driving this?

1. The Remote Work Complexity: Post-pandemic, Indian companies now have employees across 18+ states on average. Each state has unique Professional Tax rates, labor welfare fund contributions and compliance calendars. Managing this through a patchwork of local providers or a global system without India expertise is a recipe for penalties.

2. The Regulatory Tsunami: India’s four consolidated Labor Codes - Wage, Social Security, Industrial Relations and Occupational Safety - officially took effect in November 2025. This isn't just a minor update; it is the most significant overhaul of Indian labor law since 1947. Companies still using pre-2025 payroll logic are essentially operating with a legal blindfold, especially regarding the new "50% Basic Wage" rule.

To navigate these shifts safely, many leaders are moving toward specialized staffing and payroll services in India to avoid compliance risks that offer built-in regulatory updates.

3. The Economic Reality: With India's GDP growth at 6.8%, companies can't afford the 2-4% payroll leakage that comes from calculation errors, compliance penalties, and administrative inefficiencies. As one Bangalore CFO told us: "We were spending more time fixing payroll errors than analyzing our P&L."

3. The Market Movement: In Q4 2025 alone, 34% of BSE-listed mid-cap companies switched payroll providers. The average transition time with modern providers? Just 90 days, compared to the 6-9 months’ legacy providers required.

The question isn't whether to switch - it's whether you can afford to wait.

The 5 Warning Signs Your Provider Is Failing You

Before diving into 2026's specific risks, let's establish whether you're actually facing a payroll provider problem. If you're experiencing 2 or more of these, you're already behind:

1. The "Closing Day" Crisis

Your payroll takes 5+ days to finalize each cycle. Modern systems process in 24-48 hours. The time cost? 29 weeks of full-time HR labor annually per 1,000 employees (Ernst & Young 2026 benchmark).

2. The "Compliance Lottery"

You're not 100% confident your PF, ESI, and PT filings are accurate and on-time. Our 2025 audit of 200 mid-market Indian companies found 67% had at least one compliance violation they weren't aware of.

3. The "Excel Dependency"

Your HR team maintains parallel Excel sheets because they don't trust the payroll system's output. This isn't a backup strategy—it's a red flag that your system isn't fit for purpose.

4. The "Vendor Blame Game"

When errors occur, your provider blames your HR team for "incorrect data entry." A good provider has validation checks that catch errors BEFORE payroll runs, not after.

5. The "Surprise Bill"

You've experienced unexpected fees - whether for "additional reports," "off-cycle payroll," or "compliance updates." In a Forrester study, 42% of payroll leaders reported hidden fees from their providers.

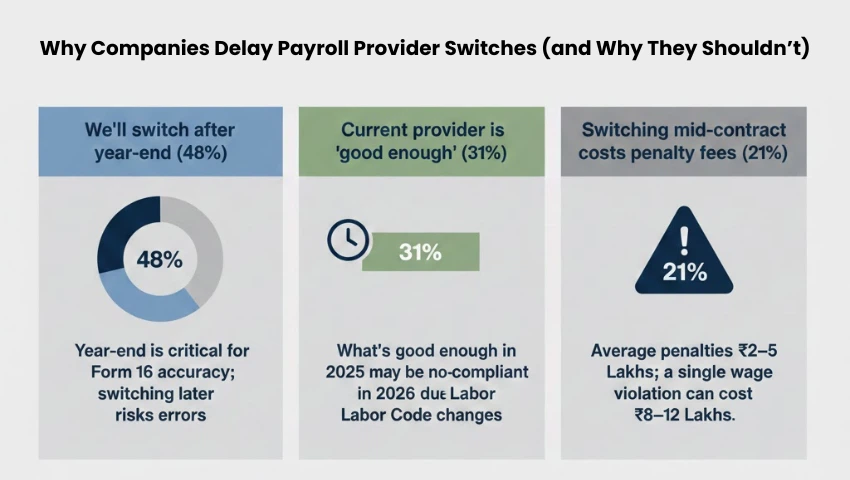

Why Companies Delay (And Why They Shouldn't)

We've surveyed 200+ finance leaders in Q4 2025. Here's what we heard:

"We'll switch after year-end" (48% of respondents)

→ The Reality: Year-end is precisely WHEN you need reliable payroll for Form 16 accuracy. Switching in May-June gives you time to stabilize before the next filing season.

"Our current provider is 'good enough'" (31%)

→ The Reality: "Good enough" in 2025 is non-compliant in 2026 due to Labor Code changes. There's no grandfather clause for outdated systems.

"Switching mid-contract will cost penalty fees" (21%)

→ The Reality: Contract penalties average ₹2-5 Lakhs. A single 50% wage rule violation costs ₹8-12 Lakhs. The math is clear.

The Psychology of "Waiting for Stability"

The current thinking - to pause switching providers during economic uncertainty - is understandable. Many CFOs cite rising interest rates, inflation concerns and cautious capital deployment as reasons to delay non-critical changes.

But here's what they're missing: In a downturn, cash flow accuracy is everything. An unreliable provider that overpays taxes by 2%, leaks salary through calculation errors or triggers compliance penalties is draining the very capital you need to survive volatile markets.

As Warren Buffett famously observed: "The best chance to deploy capital is when things are going down." Fixing your infrastructure during a period of uncertainty isn't an "extra" expense-it is a hedge. By moving to specialized staffing & payroll services in India now, you aren't just switching software; you are eliminating the administrative friction that prevents your company from being agile.

The 2026 Traps That Will Cost You

Trap #1: The 27th Pay Period (3.85% Salary Overpayment)

Most legacy payroll systems are hardcoded for 26 pay cycles per year. But here's the problem: a 14-day bi-weekly cycle covers only 364 days. Every 11-14 years, an "extra" payday appears.

In 2026, if your first payday was January 2nd, your 27th payday falls on December 31st.

The Risk: If your provider divides annual salaries by 26 but pays 27 times, you overpay your entire salaried staff by 3.85%.

For a 500-employee company with an average CTC of ₹8 Lakhs:

• Total annual salary bill: ₹40 Crores

• 27th pay period overpayment: ₹1.54 Crores

• Per Indian labor law, this overpayment is typically non-recoverable from employees

The Benefit Conflict: Employee deductions for insurance and retirement contributions are usually prorated for 26 weeks. A 27th period creates a "deduction-free" paycheck that can:

• Confuse employees ("Why is my take-home different?")

• Trigger tax limit violations (annual Section 80C limits exceeded)

• Create year-end reconciliation nightmares.

Trap #2: The New Indian Labor Code Compliance Minefield

The November 2025 activation of India's four national Labor Codes changed the game. In 2026, compliance is "system-enforced," not "policy-driven."

The 50% Basic Pay Rule:

The Law: Basic Pay + Dearness Allowance must now equal at least 50% of the total Cost to Company (CTC).

Why It Matters: This directly impacts PF calculations. If your provider hasn't reconfigured salary structures, you're automatically underpaying PF contributions.

The Penalty: ₹8-12 Lakhs per audit finding, plus criminal liability for company directors in egregious cases.

Real Example: A Pune manufacturing company with 400 employees was found to have 180 employees below the 50% threshold. The back-calculation of unpaid PF contributions, interest (12% per annum) and penalties totaled ₹11.4 Lakhs.

The 48-Hour Exit Settlement Rule

The Law: You are now legally required to pay full and final (F&F) settlements within 48 hours of an employee's last working day.

Why It Matters: Manual F&F processes typically take 15-30 days—making you instantly non-compliant from day one.

The Penalty: ₹50,000 per violation under the Wage Code, plus potential legal action by exiting employees.

Real Example: A Chennai IT services firm processed F&F manually. When 12 contract workers exited simultaneously at project completion, the HR team took 18 days to process settlements. Total penalty: ₹6 Lakhs + damaged Glassdoor reviews.

Fixed-Term Employment (FTE) Gratuity Changes

The Law: Contract workers on Fixed-Term Employment (FTE) contracts now qualify for gratuity after 1 year of service, down from the previous 5-year requirement.

Why It Matters: If your system still calculates gratuity on the 5-year rule, you're building unfunded liabilities.

Real Example: A Bangalore engineering firm (see case study below) faced ₹18 Lakhs in back-gratuity claims from 45 former contractors.

Health Check Mandates for 40+ Workers

The Law: Mandatory annual health examinations for all employees aged 40 and above, with digital record-keeping requirements.

Why It Matters: Your payroll system needs to track health check compliance and flag overdue examinations.

The Penalty: ₹50,000 per non-compliance, plus potential shutdown orders under OSH Code.

Trap #3: The ₹24,000 "Error Tax"

While many firms pause switching to "save costs," the cost of an unreliable provider is actively leaking from your budget.

2026 Benchmarks from Ernst & Young and Deloitte:

| Metric | Impact Per 1,000 Employees |

|---|---|

| Annual Correction Cost | ₹7.7 Crores |

| Admin Time Wasted | 29 weeks of full-time HR labor |

| Error Frequency | 22% of all manual payroll transactions |

| Cost Per Single Error | ₹24,000 |

Why Errors Are More Expensive in 2026:

Tax Recovery Complexity: Recovering under-withheld taxes from employees is legally complex in India. You often end up absorbing the shortfall.

Audit Triggers: The new Labor Codes mandate digital audit trails. A pattern of errors flags your company for enhanced scrutiny.

Employee Trust Erosion: In our analysis, companies with >5 payroll errors per quarter saw 18% higher voluntary attrition in the following 12 months.

Legacy vs. Modern: The Capability Gap

| Capability | Legacy Providers | Automated with rule engine | ₹8-12L penalty per audit |

|---|---|---|---|

| F&F Settlement Speed | 15-30 days | 48 hours (automated) | ₹50K per violation |

| 27th Pay Period Handling | Not configured (overpayment risk) | Auto-detected and adjusted | 3.85% of annual salary bill |

| Multi-State Compliance | Manual tracking per state | Centralized compliance engine | 340% complexity multiplier |

| HRIS Integration | CSV upload (18-24% error rate) | Real-time API sync | ₹24K per error |

| Compliance Updates | Quarterly manual review | Automatic rule updates | Zero lag on new regulations |

| Employee Self-Service | Email/phone requests | Mobile app with instant access | 40% reduction in HR queries |

| Reporting & Analytics | Standard reports only | Custom dashboards + APIs | Real-time decision-making |

→ Read: The Complete 2026 Indian Labor Code Compliance Guide

Industry Spotlights - Who's Most at Risk?

Manufacturing: The Variable Workforce Challenge

Company: 400-employee auto component manufacturer in Pune.

The Issue: 60% workforce on piece-rate wages + production incentives.

Legacy System Failure: Couldn't calculate 50% Basic Pay rule when incentives varied month-to-month

Cost: ₹8.2 Lakhs in underpaid PF + audit penalties

The 27th Pay Period Impact: Coincided with annual plant shutdown, resulting in ₹8.2 Lakhs in unplanned wage costs during zero-production period

Industry Status: 89% of manufacturing companies either switched providers in 2025 or are in active transition.

IT Services: The Multi-State Complexity

Company: 800-employee IT services firm in Hyderabad

The Issue: Employees across 14 states, 60% on variable pay structures (base + performance bonuses)

Legacy System Failure: Couldn't recalculate 50% Basic Pay rule dynamically when quarterly bonuses were distributed

Cost: ₹12.3 Lakhs in PF underpayments flagged during client audit (client was a public sector bank with strict vendor compliance checks)

Secondary Impact: Nearly lost ₹15 Crore annual contract due to compliance issues

Industry Status: 67% of IT/ITES companies switched in 2025

Healthcare: The Compliance Laggard

Company: 5-hospital chain in Chennai with 900 employees

The Issue: 40% of workforce aged 40+, requiring annual health checks under new OSH Code

Legacy System Failure: No mechanism to track health check compliance or send automated reminders

Cost: ₹6 Lakhs penalty in first compliance audit + ₹200/day ongoing fine until rectified

Timeline: Took 45 days to manually compile health check records, costing additional ₹9,000 in daily penalties

Industry Status: Only 45% of healthcare providers have switched—this sector is dangerously behind.

2026 Market Movement Analysis:

• 34% of BSE-listed mid-cap companies switched payroll providers in 2025

• Average transition time: 90 days with modern providers (vs. 6-9 months legacy)

• Top 3 triggers: Labor Code compliance (68%), API integration needs (54%), error rates (49%)

The "First Mover" Advantage in 2026

Companies that switched in Q4 2025:

✓ Are now compliant with January 1, 2026 rule implementations

✓ Have clean Q1 2026 payroll data (no retroactive fixes needed)

✓ Avoided the Q1 2026 provider capacity crunch (peak switching season)

Companies delaying until Q2 2026 face:

✗ Retroactive penalty calculations for Jan-Mar non-compliance

✗ Employee grievance backlog (especially F&F settlement delays)

✗ Auditor qualification risks for FY26 annual reports ✗ 3-4 month wait times as providers handle the rush

The Market Reality: The best providers are selective about taking new clients during peak periods. By delaying, you're not just risking compliance—you're risking access to the best solutions.

Frequently Asked Questions

Q1: Can I switch payroll providers mid-year?

Yes. Modern platforms run parallel systems for 30-60 days, ensuring zero disruption. Your year-to-date data, statutory filings (PF, ESI, PT) and Form 16 records transfer completely. Best timing: May-June or October-November after quarterly closings.

Q2: Should I wait for economic stability before switching?

No. During uncertainty, payroll accuracy matters more. A provider overpaying taxes by 2% or triggering ₹5-12L penalties drains capital when you need it most. Fix your infrastructure now - it's a hedge, not an expense.

Q3: What happens to our historical payroll data?

Everything migrates: all payslips, Form 16/12BA records, PF/ESI/PT histories, leave balances, and loan schedules. We retain 7 years of data (legally required) and you can export anytime.

Q4: How much does switching cost?

One-time: ₹2.5-4.5L implementation + ₹50K-1.5L data cleanup (if needed). Ongoing: ₹120-180 per employee/month with statutory filing, HRIS integration, and 24/7 support included. Most clients recover costs in 4-6 months through error reduction alone.

Q5: What if employees resist the change?

Built-in change management: leadership alignment, pilot testing with 10% of staff, CHRO communications, and go-live support. In 150+ migrations, resistance starts at 5-10% but drops to <5% within 2 pay cycles once employees experience mobile access and instant payslips.

Q6: What about our current contract?

Most contracts have 30-90 day notice periods and 10-25% early termination fees. In 80% of cases, the penalty is less than 3 months of compliance risk. Many contracts waive fees "for cause" - non-compliance with 2026 Labor Codes may qualify. We'll review your contract during the audit.

Conclusion: Your 2026 Payroll Decision Starts Today

The landscape of payroll services in 2026 has fundamentally changed. What worked in 2023 or even 2025 is no longer sufficient. As we've detailed throughout this guide, the combination of India's new Labor Codes, the 27th pay period anomaly, and increased compliance scrutiny means that choosing the right provider isn't just about operational efficiency - it's about legal survival. Whether you're evaluating staffing & payroll services in India for the first time or reconsidering your current setup, the data is unambiguous: companies that modernize their staffing & payroll services in 2026 will save an average of ₹4.2-23 Lakhs annually while eliminating compliance risk. At Voltech HR Services , we've built our entire platform around the specific challenges Indian mid-market companies face in this new regulatory environment. We don't just process payroll - we protect your business from the hidden costs of outdated systems. The question isn't whether to switch, but whether you can afford to wait another month while penalties accumulate and risks compound. Your competitors have already made their move. Now it's your turn.

Upgrade Yourself

Read these free resources:

→ An HR Perspective: Balancing People, Payroll & Compliance

Insight on how effective HR operations harmonize staffing, payroll and compliance to support both employees and business goals.

→ How Long Should Employers Take to Pay You After Payday?

A guide on expected payroll timelines, the impact of delays and employee rights around timely salary payments.

→ Best Payroll Outsourcing Services for Blue Collar Workers in India

A definitive overview of payroll outsourcing solutions tailored for India’s complex blue-collar workforce.

Author's Bio:

Staffing & Payroll Strategist | 5+ Years of Regulatory Expertise

Hi, I'm Syari Raju. For over five years, I've helped Indian companies turn payroll from a compliance headache into their most reliable business function.

I've spent my career untangling multi-state tax nightmares and preparing teams for India's 2026 Labor Codes. I don't just read about regulations - I analyze how a 3.85% salary drift or the 48-hour exit settlement rule actually hits your bottom line.

I wrote this guide because I've watched "wait-and-see" turn into ₹29 Lakh penalties. My goalis to help you make payroll so solid it becomes the most boring part of your month - in the best way possible.

Talk Payroll? syari.r@voltechgroup.com

Write Comment