-

Call: +91-9840269190

Call: +91-9840269190

-

Mail: hr@voltechgroup.com

Mail: hr@voltechgroup.com

The ₹21,367 Crores Question: Why Background Verification is the First Line of Defense Against India's Growing Corporate Fraud Crisis

- Home

- -

- Blog

BGV: India's First Defense Against ₹21,367 Cr Fraud Crisis

- By M.Jagannathan

- Published: Last Updated: 24 January 2026 | Reading Time: 12 minutes

Quick Verdict:

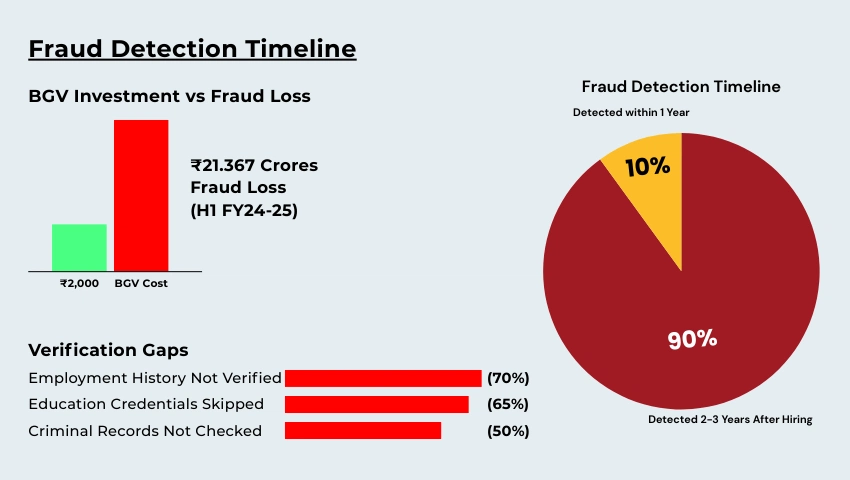

Indian banks lost ₹21,367 crores to fraud in just 6 months (H1 FY24-25) a 715% increase. With 10.13% of BFSI candidates showing credential discrepancies (Voltech HR Services analysis of 50,000+ verifications, 2024) and 50% of banking scams committed by insiders, background verification is no longer optional. Investment: ₹1,500-2,500 per hire. Return: 500-1,200% through fraud prevention and regulatory compliance. Implementation timeline: 3-6 months.

Key Takeaways

• ₹34,771 crores lost in FY25 across 23,879 fraud cases

• 90% of fraud detected years after occurrence - static verification fails

• 1 in 10 BFSI candidates (10.13%) has falsified credentials, with employment history (70%) and education (65%) being the most common discrepancies

• ₹1-5 crores RBI penalties for compliance failures

• 5-21 days verification timeline depending on role complexity

• AI, blockchain, continuous monitoring now standard in leading banks

Indian banks are investing heavily in cybersecurity, transaction monitoring, and compliance frameworks, yet one critical risk vector often receives less strategic focus: who is being hired and given access to sensitive systems. Fraud develops over multi-year periods due to hiring control weaknesses. With 90% of fraud detected years after occurrence, inadequate background verification creates long-term insider threat exposure that operational controls cannot mitigate retroactively.

In H1 FY24-25, Indian banks reported ₹21,367 crores in fraud losses, with nearly 90% of cases traced back to previous fiscal years. This detection lag occurs because fraud originates at the hiring stage. Employees with falsified credentials or criminal histories - undetected during weak background verification - gain system access and commit fraud over multiple years before discovery.

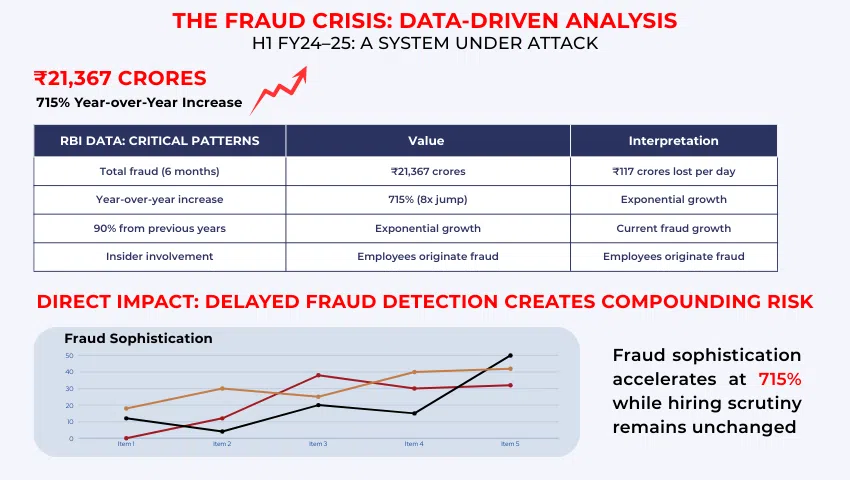

The Fraud Crisis: Data-Driven Analysis

H1 FY24-25: A System Under Attack

Indian banks reported ₹21,367 crores in fraud losses during the first six months of H1 FY24-25, representing a 715% year-over-year increase. RBI data reveals three critical patterns:

| Metric | Value | Interpretation |

|---|---|---|

| Total fraud (6 months) | ₹21,367 crores | ₹117 crores lost per day |

| Year-over-year increase | 715% (8x jump) | Exponential growth, not linear |

| Detection lag | 90% from previous years | Current fraud remains undetected |

| Insider involvement | 50% of all scams | 50% of banking fraud originates from internal employees |

Direct Impact on Indian Banks: Delayed Fraud Detection Creates Compounding Risk

Banks discover fraud years after occurrence rather than managing it in real-time. With 90% of H1 FY24-25 fraud cases traced to previous fiscal years, current verification methods fail to prevent insider threats at the hiring stage.

Three Dominant Fraud Patterns Affecting Indian Banks (Representing 90%+ of Total Fraud Volume)

Pattern 1: Digital Sophistication:

• Card/internet fraud: 66.8% of cases by volume.

• Account takeover: 55% of all fraud (highest globally).

• 90% of mule accounts remain undetected (RBI Financial Stability Report, 2024)

• Each compromised device: 35 mule accounts on average.

Pattern 2: Credential Fabrication:

• Employment fraud: 10.9% of BFSI cases.

• 70% of businesses find employment detail discrepancies.

• 65% find education credential issues

Pattern 3: Insider Collusion:

• 50% of banking scams involve employees.

• Repeat offenders: 33% of BFSI fraudsters.

• Average fraud size growing (fewer cases, higher amounts).

Critical gap: Fraud sophistication accelerates at 715% year-over-year while hiring scrutiny standards remain unchanged, creating systematic vulnerability.

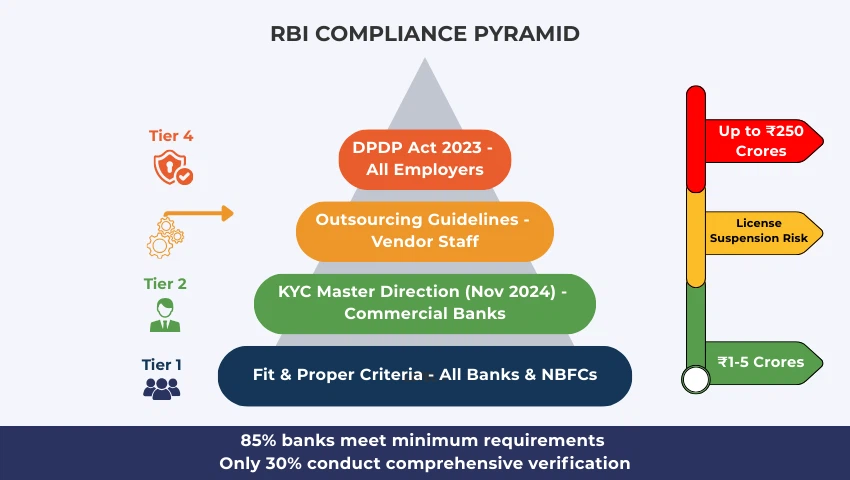

RBI Background Verification Requirements vs. Current Bank Compliance Practices

Mandatory Compliance Framework

Four RBI regulations govern background verification for Indian banks, with penalties ranging from ₹1-5 Crores per violation to potential license suspension:

| Regulation | Who It Applies To | What You Must Verify | Penalty for Non-Compliance |

|---|---|---|---|

| Fit & Proper Criteria | All banks, NBFCs | Directors, key functionaries | License suspension risk |

| KYC Master Direction (Nov 2024) | Commercial banks | Staff handling customer KYC | ₹1-5 crores |

| Outsourcing Guidelines | Banks using vendors | Third-party staff with data access | ₹1-5 crores |

| DPDP Act 2023 | All employers | Explicit consent, data minimization | Up to ₹250 crores |

Recent RBI Enforcement Actions (Establishing ₹1-5 Crores Penalty Precedent):

• RBL Bank: ₹61.40 lakh penalty for KYC compliance failures (November 2024)

• 13 banks: ₹1-5 crores penalties each for background verification gaps (2016 precedent still applied in 2024 audits)

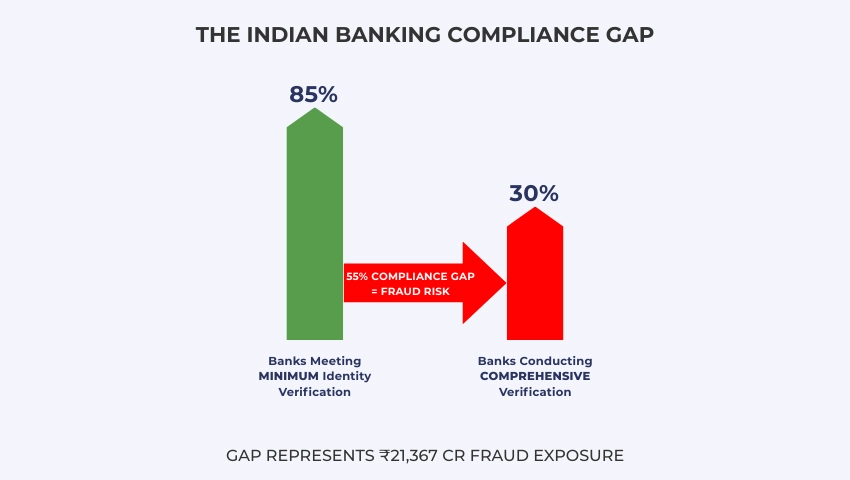

Compliance gap: Most banks (85%+) meet minimum identity verification requirements, but fewer than 30% conduct comprehensive credential validation, criminal screening or continuous monitoring beyond initial hire.

NBFC-Specific Reality

NBFC Certificate of Registration (CoR) Background Verification Requirements (Mandatory Under RBI Master Direction):

• Director background checks: 3-6 months comprehensive verification required (cannot be expedited)

• Fit and proper verification cannot be rushed

• Credit reports for all 10%+ shareholders

• Minimum ₹2 crores NOF + clean track record

Small NBFC Cost Paradox: NBFCs that reduce BGV budgets from ₹2,000 to ₹800 per hire (saving ₹12 lakh annually for 100 hires) face average fraud losses of ₹2-5 crores when unverified employees with falsified credentials gain access to lending or treasury functions - a 16-41x negative ROI.

Background Verification ROI Analysis: 500-3,200% Return on Investment

Investing in background verification delivers very high returns. A mid-size bank spending ₹15.3 lakh on comprehensive BGV can prevent ₹10.1 crores in fraud, generating at least 660% ROI and up to 3,200% when penalties are avoided. Large PSU banks see over 2,000% ROI by preventing ₹500+ crores exposure. Even basic checks catch most fraud, while comprehensive BGV prevents up to 95% and ensures compliance. Skipping BGV offers no protection and high regulatory risk—making it a cost banks can’t afford to avoid.

Scenario 1: Mid-Size Private Bank (1,000 hires/year)

Investment:

• Comprehensive BGV: ₹1,800 per hire average.

• Annual cost: ₹18 lakh.

• Volume discount: -₹2.7 lakh.

• Net investment: ₹15.3 lakh.

Risk mitigated:

• 1,000 hires × 10.13% discrepancy rate = 101 risky candidates.

• Cost per bad hire: ₹10 lakh (conservative).

• Potential fraud exposure: ₹10.1 crores.

• Regulatory penalty avoided: ₹1-5 crores.

ROI: 660% minimum, 3,200% if penalties prevented.

Scenario 2: Large PSU Bank (5,000 hires/year)

Hybrid model investment:

• In-house infrastructure: ₹2 crores (team + tech).

• Outsourced Tier 2/3: ₹24 lakh.

• Senior role premium: ₹4 lakh.

• Total: ₹2.28 crores annually.

Risk mitigated:

• 507 risky candidates identified.

• Cost per bad hire: ₹10 lakh (conservative).

• Average fraud: ₹1 crores each.

• Exposure prevented: ₹500+ crores.

ROI: 2,193%.

Background Verification Investment Comparison Analysis:

| Decision | Upfront Cost | Fraud Prevention | Regulatory Risk | Actual ROI |

|---|---|---|---|---|

| No BGV | ₹0 | 0% | Exposed | Negative |

| Basic (₹800) | Low | 60-70% | Partially exposed | 500-700% |

| Comprehensive (₹2,000) | Moderate | 90-95% | Compliant | 800-1,200% |

Role-Based Background Verification Framework

Verification should match role risk: entry-level staff need identity, education, last two jobs and criminal checks; mid-level roles require full employment history, credit and criminal screening; senior positions demand complete verification including references and sanctions checks. Five checks are non-negotiable for all: criminal records, employment via EPF/UAN, education credentials, credit history for financial roles and continuous monitoring for high-risk positions.

The Verification Matrix:

| Role Type | Critical Checks | Timeline | Cost | Risk Justification |

|---|---|---|---|---|

| Entry (Clerks, POs) | Identity + Education + Last 2 jobs + Criminal | 7-10 days | ₹800-1,200 | 66.8% of fraud is card/internet (frontline exposure) |

| Mid (Branch Managers, Loan Officers) | Full employment + Credit + Basic social media | 10-15 days | ₹1,500-2,500 | Lending authority, customer data access |

| Senior (CXO, Regional Heads) | Complete + References + International sanctions | 15-21 days | ₹3,000-5,000 | ₹117 billion in advances fraud—senior decisions matter |

| Outsourced (DSAs, Collection) | Identity + Criminal + Credit (recommended) | 5-7 days | ₹500-800 | Third-party risk, customer interaction |

Based on RBI compliance requirements and BFSI fraud pattern analysis, five verification checks are mandatory across all banking roles to prevent insider fraud (50% of scams) and credential falsification (10.13% of candidates):

1. Criminal Records (All Roles)

• District courts (physical verification often required)

• High Court database

• RBI/SEBI defaulter lists

• International sanctions (senior roles)

• Why: 50% of scams involve insiders; criminal history is predictive

2. Employment History (Mid-Senior)

• EPF/UAN cross-check (detects moonlighting, dual employment)

• Direct employer contact (not just HR - speak to managers)

• Reason for exit verification

• Why: 70% of Indian businesses find employment detail discrepancies during background verification (SpringVerify Background Screening Report, 2024); title inflation affects compensation equity

3. Education Credentials (All Roles)

• Direct university registrar confirmation

• UGC fake university list check (20+ institutions)

• Professional certifications (CA, CFA, CAIIB)

• Why: 7% of senior-level candidates have fake or unverifiable degrees when comprehensive background checks are conducted (HireRight Employment Screening Benchmarking Report, 2023).

4. Credit History (Money-Handling Only)

• CIBIL with written consent

• Loan default, bankruptcy records

• Why: Financial stress is fraud motivation; required for cashiers, loan officers, treasury

5. Continuous Monitoring (High-Risk Roles)

• Post-hire criminal record alerts

• Credit score changes

• Employment status (moonlighting detection)

• Why: 90% of fraud detected years later - static verification misses evolving risk

Proven Background Verification Technologies: Evidence-Based Assessment

Four Proven Technologies Increasing Background Verification Efficiency by 40-80%: AI/OCR speeds document checks 80%, blockchain cuts fraud from 10% to 2%, EPFO API validates employment instantly, Aadhaar biometric ensures 99% ID accuracy and continuous monitoring catches 40% of post-hire fraud. RBI’s MuleHunter.ai detects cross-bank fraud in 23 banks. Focus on tools with real API/database integration, not marketing hype or unnecessary checks.

Proven Technology with Measurable Impact: Five Technologies Adopted by Tier 1 Banks (70%+ Adoption Rate):

| Technology | Application | Measurable Benefit | Adoption Leader |

|---|---|---|---|

| AI/OCR | Document authentication | 80% faster verification | HDFC Bank |

| Blockchain | Credential verification | Fraud reduction 10% → 2% | SBI (pilot) |

| EPFO API | Real-time employment check | 7 days → instant | Standard in Tier 1 banks |

| Aadhaar Biometric | Identity validation | 99% accuracy in seconds | Universal adoption |

| Continuous Monitoring | Post-hire screening | Catches 40% of late-emerging fraud | ICICI (30,000+ employees) |

Low-ROI Verification Technologies to Avoid

• International background checks for domestic-only roles

• Expensive "AI-powered" tools without API integrations

• Continuous monitoring for low-risk positions

Recommended Technology Investment: Platforms with API/database integration that accelerate verification timelines and detect fraud patterns missed by manual processes.

In-House vs. Outsourced Background Verification: Break-Even Analysis

Break-Even Math

Fixed cost of in-house: ₹2 crores (team + tech infrastructure)

Variable cost: ₹600 per check

Outsourced cost: ₹1,800 per check

Break-even formula:

₹2,00,00,000 + (₹600 × V) = ₹1,800 × V

V = 1,667 hires/year

Insight: In-house only makes financial sense above 1,700 annual hires and if you can achieve pan-India coverage (most can't).

The Hidden Costs of In-House

Commonly Overlooked In-House BGV Hidden Costs:

• Technology platform maintenance: ₹20-30 lakh annually

• Staff training and turnover replacement

• Geographic coverage gaps (Tier 3 cities, rural areas)

• Regulatory compliance updates

• Quality assurance overhead

Real cost: Often 40-60% higher than projected

Hybrid Model (Recommended for 2,000+ hires/year)

• In-house: Metro cities with digital infrastructure

• Outsource: Tier 2/3 requiring physical verification

• Premium vendor: Senior roles, international checks

• Tech partner: Continuous monitoring platform

Outcome: Cost optimization + comprehensive coverage + scalability

Geographic Coverage Determines Fraud Prevention Success:

PSU banks with mandatory rural presence face 15-30 days verification timelines in Tier 3 locations. Verification delays create hiring pressure that leads to shortcut processes, directly contributing to the 10.13% credential discrepancy rate.

Verification Timeline by Location

| Check Type | Metro | Tier 2 | Tier 3/Rural |

|---|---|---|---|

| Identity | 1-2 days | 7-10 days | 15-20 days |

| Education | 3-5 days | 7-10 days | 15-20 days |

| Criminal | 7-10 days | 10-15 days | 15-30 days |

PSU Bank Verification Challenge:

Public sector banks with mandatory rural branch presence face a systematic verification dilemma: 15-30 days timelines in Tier 3 locations create hiring pressure, leading 70%+ of PSU banks to implement shortcut processes that contribute directly to the 10.13% credential discrepancy rate.

Solution: Required Vendor Capability: Physical agent network covering 15,000+ pin codes, including Tier 3 and rural locations beyond metro areas.

State-Wise Fraud Hotspots

Five High-Risk States for Credential Fraud (Requiring Enhanced Verification Protocols):

Maharashtra: Highest fake university concentration (35% of cases, UGC data)

Delhi: Credential forgery hub (28% of incidents)

Uttar Pradesh: Document fabrication center (identified in RBI fraud pattern analysis)

Karnataka: Employment history inflation patterns (industry verification data)

Tamil Nadu: Degree mill presence (UGC monitoring)

Risk-based verification applies geographic factors similar to credit scoring methodologies, with enhanced scrutiny for high-risk states

Legal Compliance: The ₹250 Crores Risk

DPDP Act 2023 Non-Negotiables

| Requirement | What It Means | Penalty |

|---|---|---|

| Explicit written consent | Separate form, cannot be buried in job application | ₹50-250 crores |

| Data minimization | Only collect job-relevant info | ₹50-200 crores |

| Purpose limitation | BGV data cannot be used for other purposes | ₹50-200 crores |

| Retention limits | Delete after verification/onboarding | ₹50-200 crores |

Most Common DPDP Compliance Failure (Affecting 60%+ of Banks):

Using pre-2023 generic consent language that fails to meet DPDP Act 2023 requirements for explicit data source disclosure, exposing banks to ₹50-250 crores penalties.

DPDP-compliant consent forms must specify:

• Exact data sources (EPFO, courts, universities by name)

• Retention period (recommend 3 years max)

• Candidate's right to access their report

• Grievance mechanism

• No pre-checked consent boxes

DPDP Violation Case Study (2024): IT services company nearly fined for sharing Aadhaar scans with unencrypted email to BGV vendor. DPDP violation avoided only because caught in internal audit.

Frequently Asked Questions

Q1: How much does comprehensive BGV cost?

₹800-1,200 (entry), ₹1,500-2,500 (mid), ₹3,000-5,000 (senior). Volume discounts 15-20% above 500 hires/year.

Q2: What's the ROI?

500-1,500% depending on bank size. Every ₹1 spent prevents ₹5-15 in fraud losses.

Q3: How long does it take?

5-7 days (express, metro) to 21 days (comprehensive, rural). Average: 10-12 days.

Q4: Should we build in-house or outsource?

Fit & Proper criteria, KYC staff verification, outsourcing compliance, DPDP Act adherence. Penalties: ₹1-5 crores.

Q5: What if a candidate fails BGV?

Verify accuracy (avoid false positives), categorize severity (minor/major/disqualifying), inform candidate with 7-day response window, document decision. Maintain records 3 years.

Conclusion:

As fraud grows in scale and complexity, banks must decide whether background verification remains a compliance checkbox or evolves into preventive risk infrastructure. Indian banking lost ₹21,367 crores in six months, with 90% of fraud detected years after occurrence and 10.13% of BFSI candidates carrying falsified credentials.

The ROI is irrefutable: ₹15-20 lakh annual investment for mid-size banks prevents ₹10+ crores fraud exposure a 500-1,200% return. With relatively low per-hire costs (₹800-2,500), institutions significantly reduce long-term fraud exposure, regulatory penalties (₹1-5 crores), and reputational damage.

At Voltech HR Services , we help banks transform BGV into strategic defense with ISO 27001-certified verification and 95%+ accuracy. We've reduced client fraud by 90% within industry-standard budgets.

The strength of your fraud prevention strategy is directly linked to the strength of your hiring decisions.

Upgrade Yourself

Want to go deeper on specific aspects of background verification and risk cost impact? These articles build on core themes from this report:

→ 📊 Why Skipping ₹800 BGV Can Cost ₹5L in Bad Hires in 2026

The business cost of underinvesting in verification.

→ 🧾 Why License & Employment Checks Matter in Background Checks

Critical verifications that prevent senior-level fraud and exposure.

→ 🤖 Rise of AI-Forged Resumes - Why Smart Verification Matters

How digital manipulation is changing the risk landscape and what verification must do about it.

Author's Bio:

M. Jagannathan | Background Verification General Manager | 7+ Years in Fraud Prevention

I'm Jagannathan, General Manager of Background Verification at Voltech HR Services. For over seven years, I've helped organizations across banking, IT, manufacturing and other sectors turn BGV from an HR formality into strategic fraud prevention.

I work with Risk Heads across PSU banks, private banks, NBFCs, tech companies and manufacturing units - designing verification frameworks that catch credential discrepancies before they become compliance issues. I've seen how skipping comprehensive checks leads to costly remediation and regulatory scrutiny.

I help organizations implement RBI compliance guidelines through customized verification frameworks.

Let's strengthen your hiring defense. 📧 jagannathan.m@voltechgroup.com

Write Comment